DYDX Puts Perp Platforms in DEX Season Spotlight

- CyrptoHawk's Meta Verses from the Meta Verse

- Oct 6, 2021

- 5 min read

DYDX went parabolic and we should all take note. This decentralized perpetual platform might just be the flashing neon "ENTER" sign into that glorious place called DEX season.

Consider this:

It’s turning in more volume and offering more liquidity than Coinbase. I’ve been ready for decentralized exchange (DEX) to boom, but this even caught me off guard.

All this left me thinking, it looks like people are ready to start heading to DEXs in droves, and when they get there, they'll want decentralized perpetual trading and lending platforms.

With that in mind, let’s review the factors pushing us towards DEX season and get to know a couple of the perpetual trading/lending platforms in DYDX and Mango Protocol.

Why DEX Season?

DEX’s are becoming more convenient, profitable and safer to use. This will help pull in users to the many advantages they have over centralized exchanges (CEX):

DEX advantages over CEX

Self custodial

Owners aren’t picking your pockets

No KYC requirements

Fewer fees

More rewards

Input on protocol governance.

Not on triple-double-secret FUD by China and U.S.

It is important to note that DEXs are not immune to sanctions from governments. However, it is the central exchanges that are firmly in the crosshairs now and there are more concrete legal avenues for the government to interfere.

Meanwhile, decentralized protocols are being governed by their holders and are working to define a market that gives individuals the power of their liquidity.

To get an idea of the kind of flexible financial advantages DEXs offer, check out this tweet from Mango Protocol:

Centralized exchanges are not equipped to compete with these rates, and frankly, they don't want to!

Remember, these are on chain books, so I can take advantage of offers without removing anything from the ecosystem, this helps save on fees and bookkeeping.

Now, it is important to keep in mind that DEXs have elements of centralization in them and that they are all not created equal. Each deserves it’s own research while remembering these are all very much works in progress.

Let’s take a closer look at DYDX and Mango Protocol.

DYDX

DYDX is a layer 2 Ethereum exchange where you can trade spot, margin and perpetuals as well as borrow and lend with great rates on the blockchain. It offers margin trading of up to 25x and exposure to 25 crypto assets.

There is a max fee on trades of 0.1% and even that is mitigated as trades are rewarded with the DYDX token, which compounds savings because holding DYDX will mean less fees as well.

True to it's decentralized roots, this is a governance token, so it is the holders who shape the protocol. An important process to preserve the glorious power of DeFi.

All of this lends powerful utility which is incentive for people to not just use the DYDX protocol, but hold the token. This has done good things for the price of the token!

After flying past other DEXs with parabolic growth, DYDX now has the greatest market cap of all its peers. It was trading below $10 on September 13. At the time of writing it is trading over $22 after crossing highs over $28.

Quite simply, it's flipped everything.

I don't know about you, but I'm seeing a lot of signs pointing to a growing trend here, and I'm eager to profit from it.

I haven't used DYDX yet because I keep turning all my Ethereum into jpegs. I have used Mango though, and I'm going to use it more. I've decided my best shot to get parabolic from here in this area is with Mango Protocol.

Mango Protocol

Mango Protocol is a sleek decentralized perpetual trading platform that has room for massive growth in the Solana ecosystem.

CoinGecko has it checking in at just under $325 million market cap, which is almost a billion dollars less than DYDX.

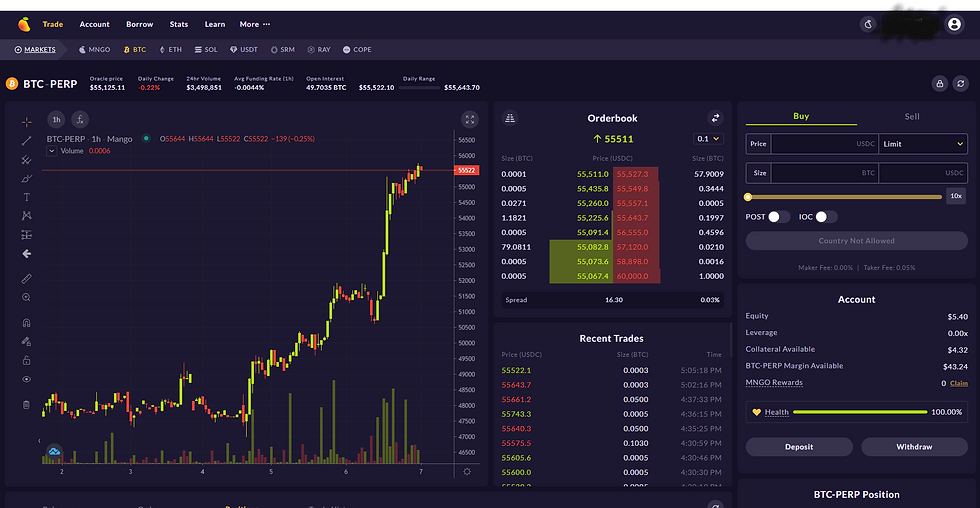

Mango doesn’t offer the deep liquidity of DYDX yet. It does, however, offer up to 10x leverage, elite speed and amazing rates, not surprising given these are calling cards of the Solana chain.

Check out some of the deals you can access if looking to borrow:

It's DEXs that are working to empower everyday people. As we can see with the rates above, Mango gives users the opportunity to borrow funds at a much lower rate than they can receive in interest from the same funds.

At that point, it's essentially paying you to borrow an appreciating asset you can take profits from. How amazing is that? (FYI: lending rates are fluid)

That’s the beauty of decentralized finance right there. You can borrow at a rate smaller than you can gather interest on the same asset at other locations. These kinds of opportunities have existed in DeFi, but now they are coming in a safer and easier-to-understand package.

Ease of Mango

Direct deposit from a Phantom wallet on Mango. From there users are free to trade perpetuals, spot, margin on individual assets or pairs.

Mango currently offers exposure to six assets: Bitcoin, Ethereum, Solana, Serum, Ray and Cope. Here is a shot of the interface:

It's easy and clear and makes all the features accessible.

It also gives ease of access to the lending. One click on the borrow tab and users can clearly see lending rates and how much is available to them in the different coins.

Keep in mind that the lending rates change, and they should be monitored to maximize their potential. This is a much easier process to grasp than figuring out hidden impermanent loss that is found throughout farming opportunities in DeFi.

Really Easy Way to Profit from Mango

Users don't have to participate in any of what I just said to profit from Mango. This proposition may be as simple as buying the coin. You get governance rights and rewards for holding with this token like DYDX, but the real value looks to be it's shot at explosive growth.

Mango is a functioning product receiving increased demand from a competent team. It's in a sector that looks ripe to boom, and the chart looks good as well.

Don't trust my TA on this one though. I've brought in a ringer. Lambda co-founder Ted Talks Macro:

Ted is on the DEX season train too, which gets me more excited about being on the train. He's also called the rise of Solana and projects in the ecosystem ahead of time and knows the platform well. Use him to help you find an entry after you've done your own research here. You can also use the AI over at Lambda Markets to help you find a good entry on Mango and more projects.

Follow me here or on Twitter too for updates on Mango lending rates and the amazing projects and developments happening in the metaverse.

Comments